ROUTE MOBILE LIMITED IPO Details

| Opens On | 9-Sep-20 |

| Closes On | 11-Sep-20 |

| Face Value | Rs 10 |

| Issue Price Band | Rs 345 – 350 |

| Issue Size | 600 Cr |

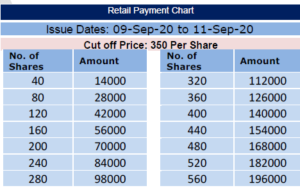

| IPO Lot Size | 40 Share then in lot of 40 Shares |

| Listing On | BSE/NSE |

| Listing Date | 21-Sep-20 |

Apply Now

Business Overview

Route Mobile Limited provide cloud‐communication platform as a service (“CPaaS”) to enterprises, over‐the‐top (“OTT”) players and mobile network operators (“MNOs”). Its range of enterprise communication services include application‐to‐peer (“A2P”) / peer‐to‐application (“P2A”) / 2Way Messaging, RCS, OTT business messaging, voice, email, and omni‐channel communication. It also offers SMS analytics, firewall, filtering and monetization, SMS hubbing and Instant Virtual Number (“IVN”) solutions to MNOs across the globe.

Retail Application Lots

Promoters

SANDIPKUMAR GUPTA AND RAJDIPKUMAR GUPTA

Route Mobile IPO Valuation

On the upper price band of Rs 350 and EPS of Rs 13.8 for FY20, the P/E ratio works out to be 25.3x. For last 3 years EPS of Rs 12.2, P/E ratio is 28.5x. For the 3 months ended June, 2020, the EPS of Rs 5.42, P/E works to be around 16.1x. Means company is asking the issue price in the range of 16x to 28x. There are no listed peers to compare whether the Route Mobile IPO Price is under priced or overpriced. However, considering latest nos of FY20 and June-20, P/E at 16x to 25x can be considered as fully priced.

Route Mobile IPO – Invest for short term to long term

Route Mobile revenues are consistently growing. Its issue price is fully priced. However, its margins are on declining mode. Considering NICHE player in the segment, high risk investors can invest in such IPOs for short term to long term. One can expect listing gains too.