TriWealth India Equity PMS

The firm focuses on investing in Indian companies which have consistent earnings and can typically generate above-average growth over longer periods of time.

We offer equity advisory services on complete need analysis that are designed to meet an individual’s requirements and financial goals.

Is Equity the Best Asset Class? Answer

Is Indian Equity worth investing? Answer

What is the probability of Loss while investing in Equity? Answer

Can I make Risk Free returns in Equity? Answer

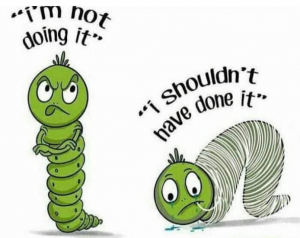

Equity Investments are not to be regretful! The process takes the fun. We simplify and make equity investments a pleasant experience.

Equity Investments are not to be regretful! The process takes the fun. We simplify and make equity investments a pleasant experience.

With a focus on equity investing and equity investment expertise inherited from over 17 years of capital markets experience, we have created a single investing philosophy that drives all our equity recommendations; be it Mutual Fund (MF) or Equity Portfolio Management Services (PMS).

Our product basket is also focused on concentrated ‘buy and hold’ Strategies in the Large Cap, Midcap and Multicap space respectively.

Some Factors on Which Our Recommendations are Based On:

- Large profit pool

- Economic Moat i.e. sustained competitive advantage reflected in return ratios (RoE, RoCE) higher than cost of capital and also those of peers

- A favorable competitive structure like monopoly or oligopoly

- Secular and stable business, preferably consumer-facing

- Positive Demand Supply situation

- Competence

- Sound business strategy

- Excellence in execution

- Rational dividend payout policy

- Integrity – Honest and transparent

- Concern for all stakeholders

- Growth mindset

- Long-range profit outlook

- Efficient capital allocation, including growth by acquisitions

Get in Touch With Us to know more.

We shall be glad to share our past performance, sample reports & investment process.

(We do not deal or recommend Speculative Activities like Tips on SMS/WhatsApp, Momentum Stock or Churning in F&O… This service is purely for value investing.)

Process

To avail equity advisory services from us, a client must have his/her demat & trading account with Zerodha Broking Ltd. If a client doesn’t have an account with Zerodha, then we provide this service from our end.

Zerodha is one of the biggest & fastest growing stock trading firms in India with very low-cost brokerage model.

Why Zerodha? Since Zerodha is the lowest brokerage broking company & its 100% working is online. It suits us. We intend to keep the cost & hassle to a minimum.

Once the account is opened or active we can sign up the agreement & start working with you.

(Ask For a detailed Presentation & Process. Also, ask for a sample agreement. Get all answers before starting your subscription or paying fees)

Apply For Trading & DEMAT Account from Zerodha – India’s Lowest Cost Equity Trading Account

Services & Fees

We have four types of equity advisory model. Our structure is as follows:

| Plan 1 | Plan 2 | Plan 3 | Plan 4 | |

| Annual Fees | 2% | 1.50% | 1.50% | 1% |

| Annual Return | 15% | 12% | 10% | 8% |

| Profit Sharing | 20% | 15% | 15% | 15% |

• All plans subject to a minimum subscription fee

• Taxes as applicable

• We follow the High Water Mark principle

Why Profit Sharing? We will only grow if you grow! Also, we are confident of our approach to delivering returns.