India is a country of Families… a good number of people belonging to multiple generations live together, to be with each other through shared feelings & common things like Business or Wealth.

The common triggers for establishing a family office include: ensuring that wealth is transferred to future generations; preserving family wealth; consolidating assets; dealing with a sudden influx of liquidity; solving family conflicts; and increasing wealth management efficiency.

What is a Family Office?

The main concerns of a High Networth Family are about wealth preservation and succession planning within family businesses continue to rise. Hence wealthy families are increasingly evaluating the benefits of setting up a family office.

The main concerns of a High Networth Family are about wealth preservation and succession planning within family businesses continue to rise. Hence wealthy families are increasingly evaluating the benefits of setting up a family office.

Family office is not a sub-set of a business: it is a vehicle for the wealthy entrepreneurs to manage their wealth independently and professionally from their businesses.

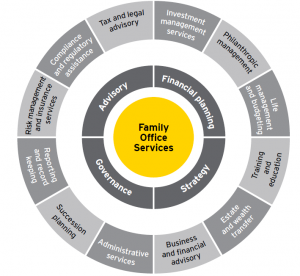

What a family office seeks to achieve is a peace of mind and a concentration of efforts for managing wealth. Instead of different advisors managing different portfolios (investment, insurance, taxes, estate planning) a family office consolidates all the personal and family wealth solutions in one place.

One of the largest aspects of wealth management is managing investments but that is only the beginning. A family office encompasses value-creation and support across various other important functions.

Why to set up a Family Office?

Following points set out the reasons why a family office makes sense:

Governance and management structure

Governance and management structure

A family office can provide governance and management structures that can deal with the complexities of the family’s wealth transparently, helping the family to avoid future conflicts. At the same time, confidentiality is ensured under the family office structure, as wealth management and other advisory services for the family members are under a single entity owned by the family.

Alignment of interest

A family office structure also ensures that there is a better alignment of interest between financial advisors and the family. Such an alignment is questionable in a non-family office structure where multiple advisers work with multiple family members.

Potential higher returns

Through the centralization and professionalization of asset management activities, family offices may be more likely to achieve higher returns, or lower risk, from their investment decisions. Family offices can also help formalize the investment process, and maximize investment returns for all family members.

Separation

Family offices allow for separation, or at least a distinction, between the family business and the family’s wealth or surplus holdings.

Centralization of risk

Family offices allow for operational consolidation of risk, performance management, and reporting. This helps the adviser and principals to make more effective decisions to meet the family’s investment objectives.

Centralization of other services

Family offices can also coordinate other professional services, including philanthropy, tax, and estate planning, family governance, communications and education, to meet the family’s mission and goals.

Who We Are & Why Us?

- A team of people having a combined experience of 35 Plus years managing the wealth of savvy clients.

- A team of people that developed an advisory practice based on strengths of Wealth Managers & weaknesses of Bankers.

- A team that is Logical and process-orientated approach.

- A team of people known for many firsts in Wealth Management Space in India.

- A team which is credited for their effectiveness in helping clients navigate some of the most volatile years in past.

Book Your Appointment Here & Let’s help to set your PersonaFamily Office