Happiest Minds Technologies IPO Details

| Opens On | 7-Sep-20 |

| Closes On | 9-Sep-20 |

| Face Value | Rs 2 |

| Issue Price Band | Rs 165-166 |

| Issue Size | 702 Cr |

| IPO Lot Size | 90 Share then 90 Shares thereon |

| Listing On | BSE/NSE |

| Listing Date | 17-Sep-20 |

Promoted by Ashok Soota and incorporated on March 30, 2011, and Positioned as “Born Digital. Born Agile” Happiest Minds Technologies Limited (“Happiest Minds”) focuses on delivering a seamless digital experience to its customers. Its offerings include, among others, digital business, product engineering, infrastructure management and security services.

Happiest Minds business is divided into the 3 Business Units (BUs):

• Digital Business Services (DBS):

• Product Engineering Services (PES):

• Infrastructure Management & Security Services (IMSS):

Its business units are supported by the 3 Centres of Excellence (CoEs):

• Internet of Things (IoT):

• Analytics / Artificial Intelligence (AI):

• Digital Process Automation (DPA):

Why Invest in this IPO?

Here are a few reasons to invest.

1) Happiest Minds Technologies one of the leading versatile digital business, product engineering and infra management solution provider company (claims as Born Digital – Born Agile).

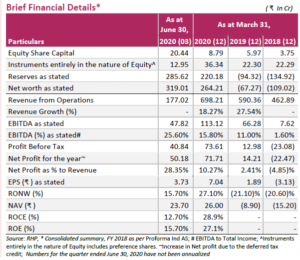

2) Company revenues and margins have shown consistent growth in the last few years.

3) The company has posted higher margins for Q1 FY21 (excluding deferred tax credit + hedging). Company indicate that it is due to ongoing cost-cutting as well as a rent reduction for its staffing parks following work from home strategy. Despite covid-19 pandemic, 77%+ of their business running smoothly and yielding rewards. Company management is confident of maintaining reasonable growth in their net earnings.

4) Happiest Minds has a glass door rating of 4.1 on a scale of ‘1- 5’ (as of the end of March, 2020), among the highest for Indian IT / Technology services companies. In the Great Place to Work survey for 2019, it has been ranked fourth in IT services, in India’s Top 25 Best Workplaces for IT & IT-BPM and among India’s Top 25 Best Workplaces for Women.

Risk in Happiest Minds Technologies IPO

1) Its customers are majorly from the USA and any geopolitical conditions in the USA would have an impact to the company business.

2) The growth, which is seen in the last few years is majorly due to acquisitions and organic growth, which might not be seen in the future at that faster pace.

3) Company has incurred losses in FY2018 majorly due to lower revenues, but maintaining costs at the same level.

4) For complete internal and external risk factors, you can refer the RHP of the company.