If you don’t have adequate health insurance, the only consolation you have is that you are with the 85% of Indians who do not have a Health insurance Policy. Health insurance penetration in India is very low and covers only 15% of the population.

Jan Schakowsky rightly said “Without health insurance, getting sick or injured could mean going bankrupt, going without needed care, or even dying needlessly.”

Not having adequate health cover makes you break into your savings or even get into debt which means your life goals will be compromised. Therefore having adequate medical insurance is inevitable.

The next question is “how much of it is enough? Most think that they have 3 or 5 Lakhs of Insurance and they think that is enough.

Let us take for example a medical procedure at a reasonable good hospital today will cost you 5 Lakhs. Even if you consider nominal inflation of 10% the cost of the same procedure will double every 7 years which means 21 years from now, you will have to shell out a whopping 40 Lakhs for the same procedure.

The answer to this problem is an ADEQUATE HEALTH INSURANCE POLICY with a Top Up Plan. Contact Us to understand, how much health insurance you need, which are the best plans & if you need a Top Up or a Super Top Up Plan.

A health insurance plan provides cover against the uncertain medical emergencies. One must have health insurance or a family floater family as per need. It helps you to avail quality treatment. It saves you money. It saves you from losing your savings.

It’s a policy which covers Hospitalisation Expenses, Major Injuries & Illness provides adequate sum required for it.

Why Health Insurance?

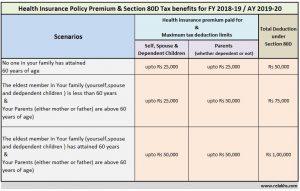

Tax Benefit of Health Insurance Policy

Some Health Industry Related Facts

Did You Know?

- 1 IN 250 INDIANS SUCCUMB TO HEART ATTACKS EVERY YEAR

- A WOMAN DIES OF CERVICAL CANCER EVERY 8 MINUTES IN INDIA

- INDIA’S YOUNGER GENERATION IS AT A GREATER RISK OF SUFFERING SERIOUS HEART AILMENTS

- 500% INCREASE IN TOTAL NUMBER OF SURGERIES PERFORMED OVER THE LAST 5 YEARS

- 1 Lakh KNEE REPLACEMENT SURGERIES PERFORMED IN INDIA ANNUALLY

- Rs 1.6 Lakhs AVERAGE SEVERITY OF THE TOP 10 SURGICAL CLAIMS

- Heart Surgeries ACCOUNT FOR THE MAXIMUM NUMBER OF HIGHEST SEVERITY CLAIMS

Features of a Good Health Insurance Policy

Why TriWealth India as your Health Insurance Partner?

TriWealth is an Insurance specialist. We are not an agent of one company. We provide you various alternatives and suggest insurance products that suit only one person – YOU.

Get best policies from ICICI Lombard, Max Bupa, Apollo Munich, Religare, HDFC, TATA, Oriental Insurance, New India Insurance & many more.