TriWealth is an Insurance specialist. We are not an agent of one company. We provide you various alternatives and suggest insurance products that suit only one person – YOU.

Get best policies from ICICI Prudential Life Insurance Company, HDFC Standard Life Life Insurance Company, Max NY Life Insurance Company, LIC of India & many more.

Various types of Life Insurance Policies in India

Term Insurance (Term Plan)

Term plan is a plan which provides protection to your family against the future uncertainties.

Term plan is a plan which provides protection to your family against the future uncertainties.

High cover in less amount.

Our family is the most important part of our life & their dreams are priceless for us. It provides financial protection in an adverse situation. We provide you a wide range of term plans which cares your families dream for a longer period in a tough time.

It also helps you to get a huge cover with a very low amount. You can pay for it monthly or annually as per your wish.

Apply for a Term Plan

Wealth Oriented Plans

Everyone wishes to have a surplus of wealth apart from the regular earnings. There can be any reason out of many to have surplus wealth i.e. .. A luxury car, A foreign trip with the family, Set up a business after retirement or a house for the family. Having a reason for wealth creation is not enough; you must also have a plan to create surplus wealth.

Everyone wishes to have a surplus of wealth apart from the regular earnings. There can be any reason out of many to have surplus wealth i.e. .. A luxury car, A foreign trip with the family, Set up a business after retirement or a house for the family. Having a reason for wealth creation is not enough; you must also have a plan to create surplus wealth.

A wealth oriented plan plays an important role to create wealth. These are basically unit linked plan with a combination of equity & debt. The only purpose is wealth creation with minimum risk.

Apply to Create Wealth With Insurance

Children’s Plan

As its name suggests; A plan which is primarily for your children’s only. There can be any reason behind it likewise, A fund for Children’s foreign education, Marriage or for Children’s Business. It’s always better to start saving from now for them because in the future it can cost you a huge amount.

As its name suggests; A plan which is primarily for your children’s only. There can be any reason behind it likewise, A fund for Children’s foreign education, Marriage or for Children’s Business. It’s always better to start saving from now for them because in the future it can cost you a huge amount.

There are lots of children’s plan available. We help you to choose the best available plan with the comparison for your child’s future.

Apply to Safe Gaurd Your Child’s Future

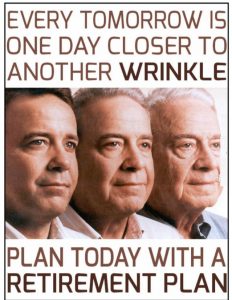

Retirement Plan

Retirement is a stage in life where one is free from his/her financial duties, need full rest & you wish to enjoy rest of your life freely. But it’s an untold fact that you have no monthly income in this stage but your expenses are still there. After some time you feel financial pressure on yourself as your savings are daily drying up.

Retirement is a stage in life where one is free from his/her financial duties, need full rest & you wish to enjoy rest of your life freely. But it’s an untold fact that you have no monthly income in this stage but your expenses are still there. After some time you feel financial pressure on yourself as your savings are daily drying up.

To overcome from this situation – A Retirement Plan is a perfect answer. A Retirement Plan is a plan which provides you monthly earnings in the form of pension to cope up with post-retirement expenses.

Apply for your personalised Retirement Plan