Portfolio Management = Portfolio Construction + Portfolio Implementation +Portfolio Review

We are specialist in Managing Investment Portfolios. (Resident, HNI, NRI & Corporate).

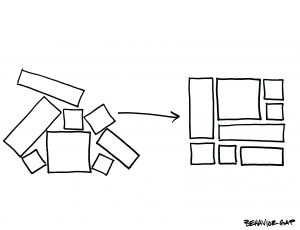

This is what WE DO, with your investments

This is what WE DO, with your investments

Important Considerations in Portfolio Management

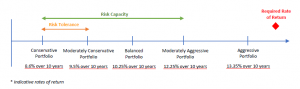

- Don’t just invest in an ad-hoc manner for your retirement or any other goal. Invest by prudently charting an asset allocation most appropriate for you.

- While drawing your asset allocation we consider

- Age

- Income & Expenses

- Asset & Liabilities

- Risk appetite

- Time horizon

- Asset allocation is an important ingredient to achieve your ultimate financial goal of a peaceful retirement

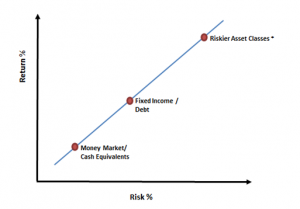

- It reduces dependency on a single asset class

- Will help you minimize risk and optimize returns of your retirement portfolio

- makes market timing almost irrelevant

- It will help you maintain adequate liquidity in your retirement portfolio

- It sets forth the right investment strategy

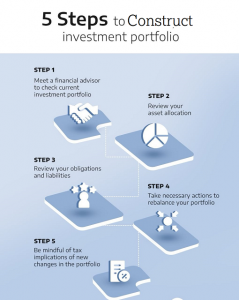

- Ensure that you review your retirement portfolio and if need be, rebalance it appropriately.

TriWealth India Portfolio Management Process

Talk to Us & Feel the Difference!

Join Us Now and See the difference!

(Disclaimer: TriWealth India is not a Mutual Fund Advisor or Distributor. It is a Financial Service Company. Mutual Fund Distribution is extended by Trident Wealth – AMFI Registered MFD with ARN 110401. Financial Planning Services are done through SEBI RIA Madhupam Krishna Reg No INA100003899 )