Why Tax Planning?

A big portion of your earning is usually eaten away by taxes. So to ensure you need to make more, & hence, tax planning becomes imperative.

Tax Planning means:

Tax Planning means:

- Invest your money in places that help you save taxes.

- Invest and earn something out of them.

PPF & NSC are traditional tax-saving products.

But just investing your money in PPF or NSC to claim tax-break would earn moderate returns. If you want to make your money work harder and earn higher returns, then mutual funds can be a great option to invest.

Besides this, you may also invest in Sukanya Samriddhi Yojana, Life Insurance, Health Insurance, National Pension Scheme & Retirement Plans to save tax under Sec 80.

CALL us for:

- Tax Planning Product comparisons.

- Investments as per your goals with minimum lock-in.

- Complete range of investments under one roof.

- Post Investments taxation work like Filling Annual Tax Returns (ITR Filing)

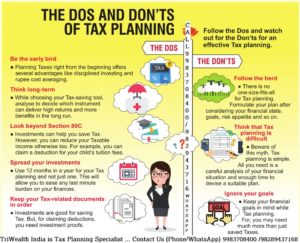

Avoiding Tax Planning Mistakes

Tax Chart for FY 2019-20 AY 2020-21